Ik werd benaderd met de vraag van een verpleegkundige in de ouderenzorg over de werking van midazolam, de medicatie die zij covid-19 patiënten zou hebben moeten toedienen. “Is dat echt een end of life drug?”, zo luidde haar vraag. Hebben ouderen die positief getest zijn daadwerkelijk een einde leven medicijn toegediend gekregen? Laten we het bewijs gewoon eens samenvatten.

Apoptose is het proces van geprogrammeerde celdood. Necrose is het afsterven van weefsel.

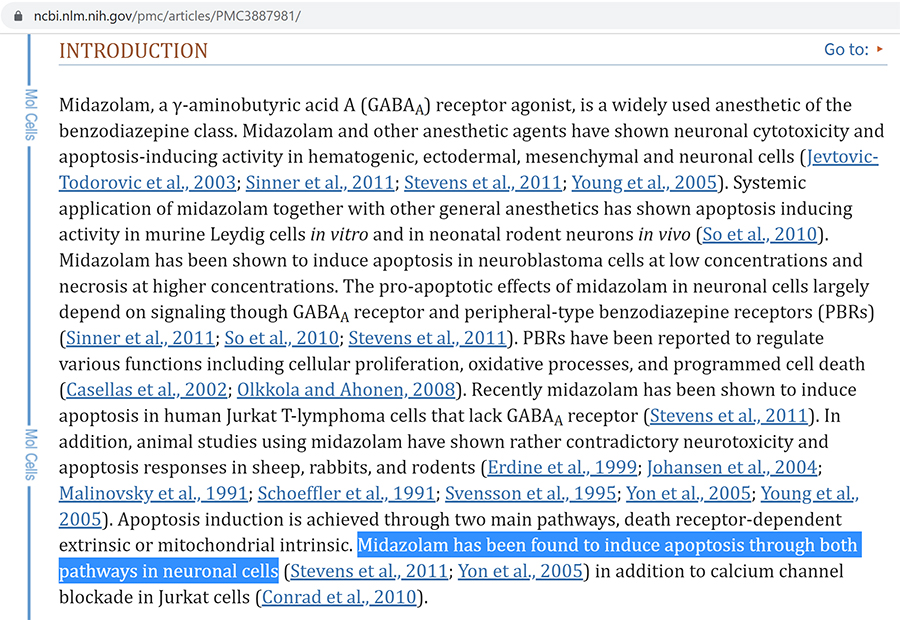

‘Van midazolam is aangetoond dat het apoptose induceert in neuroblastoomcellen bij lage concentraties en necrose bij hogere concentraties‘, dat staat letterlijk in dit onderzoek van de National Library of Medicine (screenshot):

Daar staat: Midazolam en andere anesthetica hebben neuronale cytotoxiciteit (=hersenvernietigende) en apoptose-inducerende (=celdood startende) activiteit aangetoond in hematogene (=via het bloed verspreid), ectodermale (=erfelijk DNA), mesenchymale (=stamcellen) en neuronale cellen (=hersencellen). En verder op: Van midazolam is gevonden dat het apoptose (=celdood) induceert (=start) via beide routes in neuronale cellen (=hersencellen)‘. Het breekt dus cellen af; waaronder neuronale cellen (=hersencellen).

Hoe duidelijk wilt u het hebben? Midazolam breekt cellen af. Het induceert celdood. Het is een einde leven medicatie, dat gebruikt wordt als niets meer werkt en de patiënt zo min mogelijk moet voelen (zo wordt de verpleegkundigen verteld). Celdood versnellen is dan blijkbaar de oplossing (want zenuwbanen die pijnsignalen aan de hersenen doorgeven zijn ook cellen en hersencellen – neuronal cells – sterven af door midazolam).

En hoe is midazolm aangeprezen onder verpleegkundig personeel? Nou, dat zit zo: mensen worden aan een beademingsapparaat (klik op de link) gelegd, waarna ze deze celdodende drugs toegediend krijgen. Dat verwoord je dan zo:

De huidige richtlijn palliatieve sedatie is ontoereikend bij covid-19-patiënten met een hoge zuurstofbehoefte. Hogere doseringen midazolam en een actief anticiperend beleid leiden tot meer comfort bij deze patiënten.

Je krijgt dus als verpleegkundige te horen dat je voor meer comfort bij de patiënt zorgt, niet wetende dat je hem of haar een einde leven drug toedient. In plaats van dat de vermeende ziekte dus behandeld wordt, wordt de “patiënt” met ademhalingsproblemen een slang in de keel gepropt, waardoor hij of zij niet meer zelfstandig kan ademhalen, om vervolgens een cel-afbrekend (einde leven) medicijn toe te dienen. Ik noem dat euthanasie in een lief jasje.

“Ja, maar het gaat toch om palliatieve ( =uitbehandeld of stervende) sedatie? Dan waren de mensen die dit kregen toch al stervende? Of begrijp ik het verkeerd?“, zo zou u nu kunnen denken. Oké, dus men doet je bij kortademigheid meteen aan de beademingsapparatuur om vervolgens midazolam toe te dienen. Is kortademigheid ‘palliatief’? Ben je bij ademhalingsproblemen ‘uitbehandeld’? Uitbehandeld doordat je geen adem meer krijgt met die slang in je keel? Wat weet Diederik Gommers hiervan?

Shocking vindt u niet? De keurige bewoordingen maken het niet anders: Midazolam breekt celweefsel af en maakt je dood. Verpleegkundigen hebben zonder te weten meegewerkt aan grootschalig beëindiging van het leven van mensen die binnengebracht zijn met ademhalingsproblemen (covid patiënten genoemd). Verpleegkundigen hebben dus, zonder te weten, meegewerkt aan moord via medicatie. Je zou het ook genocide kunnen noemen, maar dat klinkt niet lief.

MUST READS:

Positief getest? Bel nu de GGD en vraag om een bloedtest voor bewijs! #beldeggdvoorbewijs

COVID zwendel valt uit elkaar; het is voorbij

Ernst Kuipers en het falende beddenbezettingssoftwaresysteem: wat is belangrijker de belangenverstrengeling of maatwerkcijfers voor de coronahoax? – door Martin Vrijland

Dr. Bryan Ardis: covid-19 is verspreid via het drinkwater (Update)

https://www.martinvrijland.nl/nieuws-analyses/dr-bryan-ardis-covid-19-is-verspreid-via-het-drinkwater/

Is de Shanghai lockdown onderdeel van de strategie de westerse economie te slopen?

https://www.martinvrijland.nl/nieuws-analyses/is-de-shanghai-lockdown-onderdeel-van-de-strategie-de-westerse-economie-te-slopen/

Ons voortbestaan

https://www.martinvrijland.nl/nieuws-analyses/ons-voortbestaan/

De nieuwst hoax? ‘Androgenen (mannelijke hormonen) zorgen voor meer kanker en covid gevoeligheid’

https://www.martinvrijland.nl/nieuws-analyses/de-nieuwst-hoax-androgenen-mannelijk-hormonen-zorgen-voor-meer-kanker-en-covid-gevoeligheid/

“One of the most disturbing promotional tweets of the year from the DIRECTOR GENERAL OF THE WORLD HEALTH ORGANISATION. Think about it. REALLY think about it.

https://twitter.com/DrTedros/status/1515010722538954756”

https://twitter.com/DrAseemMalhotra/status/1515588078408245252

“Thank you @BillGates

for sending a copy of your new book. I fully agree that we must act on #COVID19’s lessons and innovate so that we can deliver swift, equitable health solutions to prevent the next pandemic. @gatesfoundation

https://twitter.com/DrTedros/status/1515010722538954756/photo/1”

https://twitter.com/DrTedros/status/1515010722538954756

Welke klimaatcrisis?

https://www.climategate.nl/2022/04/welke-klimaatcrisis/

De gevreesde doelstelling van 1,5 graad C is dood

https://www.climategate.nl/2022/04/het-gevreesde-doel-van-15-graad-is-dood/

The dread 1.5 degree target is dead

https://www.cfact.org/2022/04/08/the-dread-1-5-degree-target-is-dead/

Energietransitie in stervensnood

https://www.climategate.nl/2022/04/energietransitie-in-stervensnood/

Energy transition in agony

https://irinaslav.substack.com/p/energy-transition-in-agony?s=r

Leuren met windmolens

https://www.climategate.nl/2022/04/leuren-met-windmolens/

De mislukte energietransitie en de onmisbare Russische gasleveringen

https://www.climategate.nl/2022/04/de-mislukte-energietransitie-en-de-onmisbare-russische-gasleveringen/

Oproep: Hou uw kinderen weg van het Nationaal Jeugdinstituut !

https://www.climategate.nl/2022/04/oproep-hou-uw-kinderen-weg-van-het-nationaal-jeugdinstituut/

Einde van De Groene Revolutie – Waarom Europa’s ‘Farm to Fork’-beleid honger zal doen toenemen

https://www.climategate.nl/2022/04/einde-van-de-groene-revolutie-waarom-europas-farm-to-fork-beleid-de-honger-zal-doen-toenemen/

After energy poverty, food poverty

https://www-contrepoints-org.translate.goog/2022/03/27/424194-apres-la-precarite-energetique-la-precarite-alimentaire?_x_tr_sl=auto&_x_tr_tl=en&_x_tr_hl=en&_x_tr_pto=wapp

Wat gebeurt er als groene energie faalt?

https://www.climategate.nl/2022/04/wat-gebeurt-er-als-groene-energie-faalt/

Onderzoekers: Mysterieuze veranderingen in temperatuur Neptunus

https://www.ad.nl/wetenschap/onderzoekers-mysterieuze-veranderingen-in-temperatuur-neptunus~a480d189/

Klimaatverandering op Neptunus ?

https://www.climategate.nl/2022/04/klimaatverandering-op-neptunis/

Klimaatverandering op Neptunus?

Planeet werd jarenlang steeds kouder, maar warmt nu in rap tempo weer op

https://www.dutchcowboys.nl/technology/klimaatverandering-op-neptunus

“Debt Saturation: Off the Cliff We Go

When the system can’t borrow more and distribute the insolvency, it implodes

I started writing about debt saturation back in 2011. The basic idea is we can continue to borrow and spend as long as one of two conditions hold: 1) real (inflation-adjusted) income is rising, so there’s more income to service additional debt, or 2) the cost of borrowing declines so the same income can support more debt.

After 13 long years of declining interest rates and stagnant incomes for the bottom 90%, we’ve finally reached debt saturation: after dropping to near-zero, interest rates are now rising, pushing the cost of debt service higher, while wages are losing purchasing power (a.k.a. inflation), so there’s less disposable income left to service debt.

The game plan for the past 13 years was to fund “growth” today by borrowing vast sums from future incomes: the $1.6 trillion in student loan debt, for example, was supposed to be paid by the soaring wages of all those student-loan-serfs, and all the sovereign debt was supposed to be paid by the soaring tax revenues from rapidly expanding economies.

These fantasies have now run aground on the unforgiving shoals of reality. There’s no way to expand debt if income is losing ground and the cost of borrowing is soaring.

As I observed in 2012, Spreading Insolvency Around Does Not Create Solvency (August 23, 2012). In 2011, I used a different analogy: The World Is Drowning in Debt, and Europe Laces On Concrete Boots (November 14, 2011).

Saturation is an interesting phenomenon. You keep adding more and more to a system that seems to absorb “more” with no ill effects, and then suddenly the whole mountainside gives way and rumbles off the cliff.

There’s a runaway feedback loop aspect to debt saturation. Think of a planetary atmosphere where you keep adding greenhouse gases. The atmosphere keeps absorbing more greenhouse gases with little effect until a saturation point is reached and then the atmosphere loses its negative feedback mechanisms that kept the system stable.

At that point, the feedback is all positive, i.e. every additional unit of greenhouse gases doesn’t just trap an additional unit of heat, it multiplies the effect. (The atmosphere of Venus is hot enough to melt lead–900 F or 475 C.)

We see this same dynamic in debt saturation: the breakdown is accelerating rapidly. Since households burned through their stimulus bonanza, the savings rate has fallen and credit card balances are soaring. But this is not low-cost debt, it’s high-cost debt, so those additional credit card balances will soon stripmine disposable income, leaving less for additional spending or debt service.

The “temporary debt forgiveness” ploy is staving off the day of reckoning in student loan serfdom. Rather than admit the student loan scam is unsustainable, the status quo plays an absurd game of pushing the date that student loan interest will have to be paid forward. This works until it doesn’t.

Meanwhile, with mortgage rates over 5% for the first time in a decade, the housing bubble is popping. The runaway feedback of higher mortgages and slowing sales will accelerate price declines and mortgage delinquencies far faster than the mainstream anticipates.

Rising bond yields will push the cost of government borrowing higher, too. Borrowing money to pay the interest on borrowing money is another feedback loop of doom: it’s downright inconvenient when most of the income tax revenues are devoted to servicing government debt, leaving little for the rest of the government’s vast spending.

There’s a lot of shuck and jive in income and wealth statistics to mask the doom-loop of debt saturation. Oh, the household is still doing just fine, we’re told: look at all the luscious wealth and income available to service more debt.

What punctures the pretty fantasy is the reality that only the top 5% have plenty of income and wealth. The top 1% collect around 20% of all income and own 50% of all financial wealth, and the top 10% collect over 50% of all income and own roughly 90% of financial assets.

The bottom 50% of households own less than 1% of financial wealth and the bottom 90% will discover how much of their “wealth” is phantom when the stock and housing bubbles pop.

The point is wealth and income are highly concentrated in the U.S., so claiming households have plenty of wealth and income is a gross distortion. Yes, the top 5% (7 million households) could borrow more, but they have enough wealth and income that they don’t need to borrow more.

Those who need to borrow more to survive can’t borrow more: households, zombie corporations, and local znd national governments.

Top 1% of U.S. Earners Now Hold More Wealth Than All of the Middle Class

The U.S. Income Distribution: Trends and Issues

There’s no tricks left to keep expanding debt: rates are rising, not falling, and wages are losing ground to the soaring costs of rent, adjustable mortgages, healthcare, childcare, food, energy, junk fees, property taxes, etc. As for the phantom wealth of bubbles: as rates rise and the Federal Reserve trims its stimulus, all the bubbles will pop.

When the system can’t borrow more and distribute the insolvency, it implodes. And so off the cliff we go.”

http://charleshughsmith.blogspot.com/2022/04/debt-saturation-off-cliff-we-go.html

Vladimir Putin is niet de luis in de pels van de World Economic Forum plannen richting een totalitair wereldregiem – door Martin Vrijland

https://wakkeren.nl/vladimir-putin-is-niet-de-luis-in-de-pels-van-de-world-economic-forum-plannen-richting-een-totalitair-wereldregiem-door-martin-vrijland/

WAR ON FOOD SUPPLY targets Eggs and Chickens

https://www.youtube.com/watch?v=LgQxsZZx_nY

Anti-Viral or Nonsense – Webinar From April 1st, 2022

https://www.bitchute.com/video/qhyrm8C6nm2N/

“In this webinar, I reviewed the following article titled “Modern Medicine: A Castle Built on Sand?”

You can find the article here: https://dailyexpose.uk/2022/03/31/modern-medicine-a-castle-built-on-sand/

I then shared a video featuring Mike Donio, John Blaid, Jacob Diaz, Mike Stone, and Alec Zeck, where they filmed a response to claims made by Dr. Peter McCullough, Dr. Robert Malone, and Dr. Ryan Cole regarding virus isolation and the existence of SARS-CoV-2 during an episode of The StreetMD Show hosted by Dr. Jo Yi on the Ickonic platform.

You can find the original video here: https://www.bitchute.com/video/bqfEhbhYWYE1/”

Response to Fuellmich: Fact or Fiction? Live Webinar on YouTube From April 20, 2022

https://www.bitchute.com/video/hskSiQtG9YqV/

“I hosted a live webinar on YouTube on April 20, 2022.

I discussed my response to Dr. Reiner Fuellmich, who claims that he and his team believe that AIDS has been placed in the injections and is going to affect the population. Is this fact or fiction? Tune in to find out.

I also referenced several papers in my discussion; they can be found at the links below:

http://perspectivesinmedicine.cshlp.org/content/1/1/a006841.long#ref-29

https://sci-hub.se/10.1126/science.6189183

https://academic.oup.com/aje/article/146/4/350/60711?login=false“

“The Dam Is Finally Cracking

We all sense the global order has cracked. The existing order is breaking down on multiple fronts.

Those who have benefited from this arrangement are doing everything in their power to patch the cracks, while those who chafed under the old order’s chains seek a new order that suits their interests.

The task now is to make sense of this complex inflection point in history. Two statements summarize the transition from the existing global order to the next iteration:

1. Finance dominated resources in the old order. Now the roles will reverse and real-world resources will dominate finance. We can’t “print our way” out of scarcities.

2. Reshuffling currencies and credit will not stop the breakdown of the global order’s “waste is growth” Landfill Economy Model.

Playing financial tricks has extended the life of an unsustainable economic model that glorified “growth” from wasting resources. By expanding credit “money,” the current global order fueled unsustainable consumption driven by unsustainable speculation.

Stop expanding “money” and credit and the global order of “growth” implodes.

The Dam Is Finally Cracking

Unfortunately for all those who benefited from soaring wealth and income inequality, the trick of expanding “money” and credit has reached systemic limits. The dam holding all the toxic debt, leverage and fraud is finally cracking.

The dominance of resources over finance leads to a multipolar global order, an order that has the potential to be far more stable and sustainable than the unsustainable, destabilizing “waste is growth” model that depends on financial fraud to maintain the illusion of “growth.”

As I explain in my book Global Crisis, National Renewal, scarcity leads to either social disorder or rationing. This article explains how government’s role will shift from boosting demand (the Keynesian Cargo Cult) to limiting demand in ways that maintain the social contract.

Nations that fail to adapt to the end of financialization and globalization will unravel. Every nation has a choice which path it takes:

Cling on to the doomed existing order of financialization, globalization and the “waste is growth” Landfill Economy or embrace a multipolar world and a degrowth model of doing more with less and incentivizing efficiency and durability rather than the shoddy planned obsolescence of the debt-dependent Landfill Economy.

Free Money Is the Solution

Under various guises, labels and rationalizations, “free money” has now been established as the default policy fix for any problem. Stock market falters? The solution: free money! Economy falters? The solution: free money! Bankers face collapse from ruinously risky bets? The solution: free money! Infrastructure crumbling?

The solution: free money!

Inflation raging? The solution: free money! Ruh-roh. We have a problem free money won’t fix. Instead, free money accelerates the conflagration. Dang, this is inconvenient; the solution to every problem makes this problem worse. Now what do we do?

Despite the apparent surprise of the policy-makers, pundits and apologists, this was common sense. Create trillions of dollars out of thin air and spread the money around indiscriminately (fraudsters and scammers getting more than the honest, of course) after global supply chains were disrupted and shelves were bare, then open the floodgates of speculative gambling in stocks, cryptos, housing, used cars, bat guano, quatloos, etc., and what do you think will happen?

Supply can’t catch up with free-money-boosted demand, prices rise, people instinctively over-order and over-buy, and “don’t fight the Fed” speculative betting begets more betting: the inflation rocket booster ignites, wages soar as workers try to keep pace with rising expenses, speculative bubbles inflate to unprecedented extremes, and all this “wealth without work or productivity” gooses spending and gross domestic product (GDP).

“Once the Bubbles Pop, GDP Crashes and the Ratio Blows Out”

Forty years ago, the total debt-to-GDP ratio was 1.6: debt was $4.8 trillion and GDP was $3 trillion. Then the policy solutions of fiscal “borrow and spend” and Federal Reserve “balance sheet expansion.” a.k.a. free money, became the policy default.

The ratio rose to 2.76 in 2000 and has wobbled around 3.7 for the past decade, a decade that just so happened to see the stock market quadruple and the housing bubble reinflate to new heights as the Federal Reserve kept interest rates near zero as part of the “free money” policy:

If we’re going to borrow tens of trillions of dollars to squander, we need near-zero interest rates to keep costs of borrowing down.

Though no one in a position of power or influence dares admit it, the ratio of debt to GDP hasn’t blown out for one reason: speculative bubbles have pushed GDP higher in a massive, sustained distortion of “wealth effect” and winner take most gains for those who knew how to extract the majority of gains from the bubbles.

Once the bubbles pop, GDP crashes and the ratio blows out. The belief that adding trillions in debt magically adds GDP will be revealed as delusional fantasy.

Two Paths

Completely forgotten in the era of Free money as the solution to all problems is the discipline of frugality, which can best be defined as discipline over spending as a means of building long-term financial stability and general well-being.

Financial discipline (frugality) has been set aside as a needless discomfort: why make difficult tradeoffs and sacrifices when the solution is just to borrow/create more free money? Indeed. Along the same lines, why bother with all the hassles of healthy food and fitness? Just pig out and swallow a couple handfuls of “free” (heh) meds.

Discipline isn’t just about limiting waste. It’s about investing capital and labor wisely to secure future gains in productivity which is the only real source of income and wealth. Creating “money” out of thin air and spreading it around to satisfy every constituency doesn’t increase productivity. It destroys productivity by incentivizing waste – the waste is growth Landfill Economy – and speculative bets on bubbles never popping.

Alas, all bubbles pop, and now that creating free money only makes costs rise faster, there is no solution other than – oh, dear, dear, dear – the unforgiving discipline of frugality and investing for productivity gains rather than for speculative bubble “wealth.”

Which path leads to doom? Free money. Which path leads to revival? Frugality and discipline.

That’s not what everyone wants to hear, but clinging to delusional fantasies of “free wealth” won’t lead to positive outcomes, any more than swallowing handfuls of meds leads to “free health.””

https://dailyreckoning.com/the-dam-is-finally-cracking/

Deadly: COVID vaccine smoking gun; AstraZeneca CEO reveals the secret

https://blog.nomorefakenews.com/2022/04/20/deadly-covid-vaccine-smoking-gun-astrazeneca-ceo-reveals-the-secret/

President von der Leyen – COVID Travel Pass / EU Digital COVID Certificate (2022)

https://www.youtube.com/watch?v=6bUcqsjTuG4

“President Ursula von der Leyen:

Before Easter, we promised to the Europeans that we will do everything possible so that they can gain back some normality when planning for their well-deserved summer holidays. So on Monday, the European Parliament and the Council signed the Regulation for the . It is applicable from 1 July on, but if you want to, as a Member State, you can sign up early voluntarily.

And that is what Belgium did. Belgium allows, as of today, to travel with the Certificate and they issue these Certificates. And here is mine. So everyone who is fully vaccinated, or tested negative or has recovered from COVID-19, can get one. And we have right now 15 Member States that have already signed up. And from 1 July, all 27 Member States have to apply these EU Digital COVID Certificates.

I am planning now to start my tour through 27 Member States for the NextGenerationEU, our Recovery and Resilience Plan, and I am very curious to test and to see how this Certificate will work. Thank you.”

“Pandemic Treaty” will hand WHO keys to global government

Suggested clauses would incentivize reporting “pandemics”, and see nations punished for “non-compliance”

https://off-guardian.org/2022/04/19/pandemic-treaty-will-hand-who-keys-to-global-government/

Autoimmune hepatitis developing after coronavirus disease 2019 (COVID-19) vaccine: Causality or casualty?

https://www.journal-of-hepatology.eu/article/S0168-8278(21)00237-3/fulltext